Introduction: Avon’s Pricing Landscape

Insights from Natasza Włodarczykon, Global Pricing Manager at Avon on Inventory Pricing Strategies

The 11th DPC event was held on the 5th of September 2023 with a total of 31 attendees including companies such as Flaconi, Babymarkt, Hartmann, Flink, Westwing, and Phoenix Group. Natasza Włodarczyk, leader of the pricing experts team at Avon for Europe and Latin America, shared valuable insights into Avon’s inventory pricing strategies. Avon, a prominent cosmetics retailer based in London with a $9.1 billion annual sales revenue in 2020, faces unique challenges due to its direct-to-customer sales approach and its role as a cosmetics producer.

Complexity of Avon’s Pricing Activities

Natasza emphasized the complexity of Avon’s pricing activities, with multiple teams dedicated to pricing at different organizational levels. She said: “Our role is basically not pricing, but RGM and we have even three different levels in the company of the different teams dealing with pricing.” She further elaborated on Avon’s diverse sales channels, including “online, via representatives, via social channels, and we are also printing brochures.” Additionally, Avon’s role as a cosmetics producer in Poland adds further complexity to its inventory pricing strategy.

The Role of Inventory Pricing

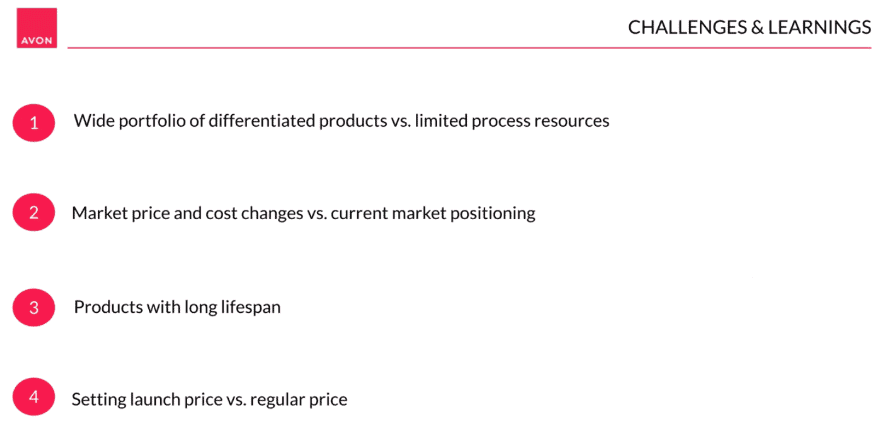

Natasza highlighted that while inventory pricing is not the primary focus of Avon’s pricing strategy, it plays a crucial role in their overall approach since “It’s not possible to do this pricing in any company without analyzing inventory from a pricing perspective.” She mentioned several challenges related to inventory pricing, such as production costs, demand forecasting, and the diverse sales channels they utilize, including wholesalers.

Shifting Pricing Strategies

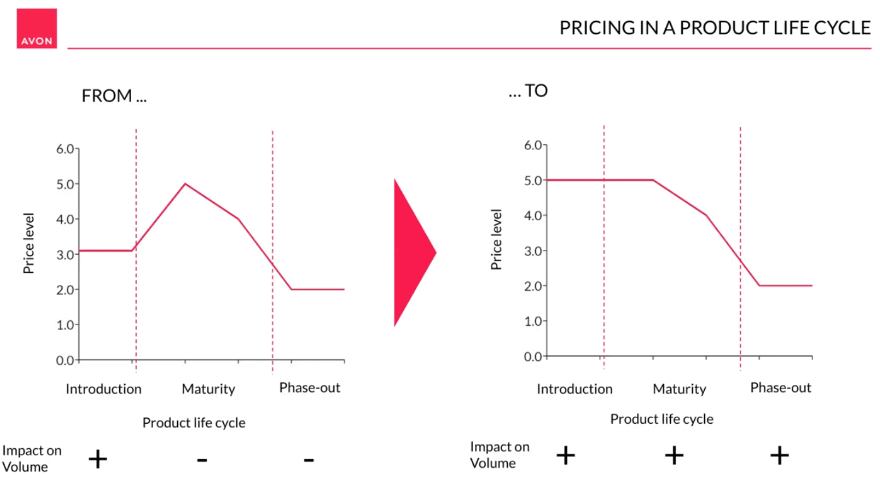

Avon previously followed a strategy of offering promotional prices for new products to boost sales but found that this approach often led to challenges in managing volume and demand. As Natasza mentioned: “We were trying, especially for the products that are new, unique, and when we were really investing a lot, to put the high price from the beginning.” Over time, they shifted toward setting higher launch prices for unique products, which allowed for more effective promotions during the maturity phase. This strategy not only optimized volume impact but also improved margin estimation.

Challenges in Implementation

Natasza also addressed the challenges Avon faced in implementing this pricing strategy, particularly during the COVID-19 pandemic and when dealing with products in different categories. She noted: “We finally realized that this is not so easy to deal with such a strategy and introduce it for all the products across our portfolio.” They discovered the need to differentiate their pricing strategy for unique and non-unique products and faced issues with market price fluctuations and cost changes.

Market Positioning and Pricing

Natasza highlighted: “How we set launch price is strongly connected to our position in the market.” Avon’s success varies based on market share and the role of retail channels. While this strategy resulted in extra margin, its impact on volume differed across markets.

Conclusion: Insights into Avon’s Pricing Journey

In summary, Natasza Włodarczyk’s presentation shed light on Avon’s intricate inventory pricing strategies, emphasizing their shift from promotional pricing to higher launch prices for unique products. Avon’s journey highlights the challenges and successes associated with managing inventory pricing in a dynamic and competitive market.

Q&A

Q1: Sahin Tezsoy (Director of Pricing Management at LUQOM GROUP): How do you ensure that your skimming pricing strategy works in price-sensitive markets, especially with competition from drugstores and in times of inflation and recession?

A1: Natasza Włodarczykon (Global Pricing Manager at Avon): We use data analysis, adapt our business model, and control paid channels. We monitor competitors and use short-term promotions based on observations.

Q2: Sahin Tezsoy: How do you avoid pricing out of the market with private labeling and control over paid channels?

A2: Natasza: We benchmark against competitors, use pricing corridors, and adapt to real-time data. It’s complex due to sales through representatives.

Q3: Sahin Tezsoy: How do you manage pricing in printed catalogs with limited flexibility due to advanced printing?

A3: Natasza: We adapt based on real-time data, including promotional pricing and bundling.

Q4: Sahin Tezsoy: How do you deal with cost increases and competing against private labels in supermarkets?

A4: Natasza: Due to cost increases, we can’t compete with very low private label prices in supermarkets.

Being a Dynamic Pricing Community member

We strive to create a space for sparking and maintaining lasting connections between retail pricing practitioners, enthusiasts and experts.

By surrounding yourself with the best experts the field has to offer, you can address and learn more about the current challenges in the pricing in retail industry, advance your pricing expertise and expand your pricing network.

Who will you meet?

Free of charge, but only selected members are accepted, so we keep the discussions relevant and at a high standard of expertise.

Conditions

- Professionals with experience in business, pricing, marketing

- People working for a retailer, brand, or aggregator. Our content and events bring the most relevant insights to these industries

- Members who are open to sharing their knowledge and network. This group is for creating and nurturing relationships by discussing and sharing experiences, knowledge, and resources

Benefits

- Timely pricing tech updates via closed LinkedIn Group

- Networking with top pricing practitioners

- Access to exclusive knowledge-sharing webinars